Table of Contents

ToggleCosmetic Import Registration Fees in India (COS-1 & COS-2)

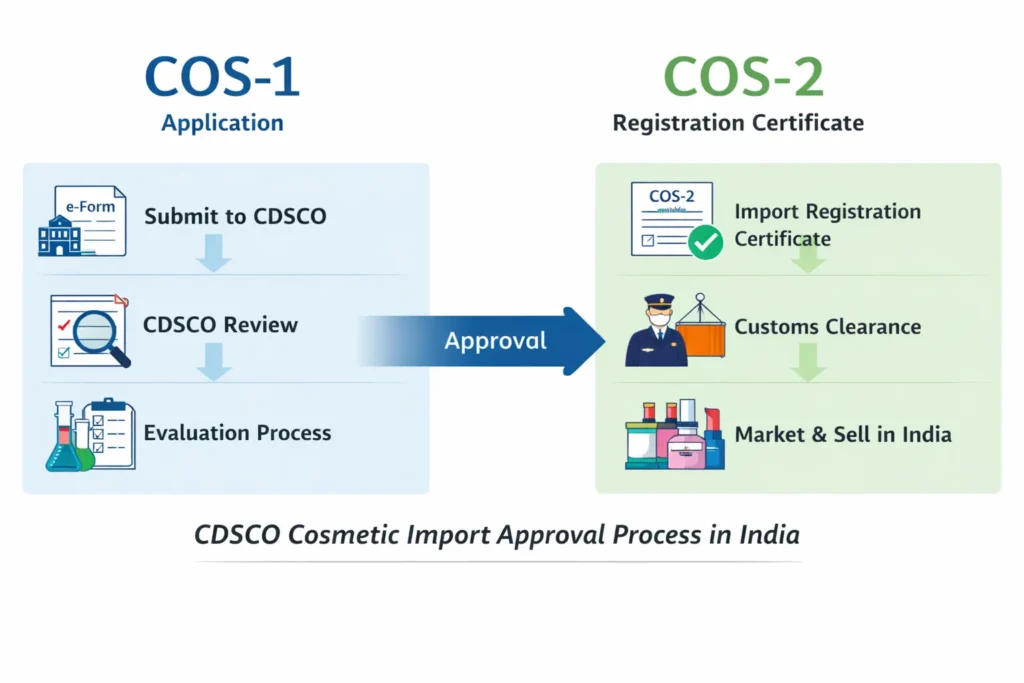

Understanding the cosmetic import registration fees in India is essential for importers planning to bring cosmetic products into the Indian market. The Central Drugs Standard Control Organization (CDSCO) mandates payment of government fees for registering cosmetic products under COS-1 and COS-2 as per the Cosmetic Rules, 2020. Businesses commonly refer to these fees as cosmetic import license fees, although CDSCO follows a registration-based approval process.

This guide explains the CDSCO cosmetic import registration fee structure, what the fees include, how they are calculated, and common mistakes importers must avoid.

Before reviewing the cosmetic import registration fee structure in detail, it is important to understand the overall regulatory framework governing cosmetic imports in India. The CDSCO approval process involves specific eligibility criteria, application procedures, documentation standards, and post-approval compliance requirements. For a complete explanation of this regulatory framework, refer to our Cosmetic Import License in India: CDSCO COS-1 & COS-2 Guide, which explains the import registration process from application to final approval.

What is Cosmetic Import Registration Fees?

CDSCO charges cosmetic import registration fees as statutory government payments for approving cosmetic imports into India. These fees apply to:

Each cosmetic category

Each manufacturing site

Each product variant

Although many businesses refer to these charges as cosmetic import license fees, CDSCO legally issues an import registration certificate (COS-2) after approval of the COS-1 application.

CDSCO Cosmetic Import Registration Fee Structure (COS-1 & COS-2)

The government fee structure for cosmetic import registration in India is fixed and non-refundable.

CDSCO Government Fees

USD 1,000 – Per cosmetic category

USD 500 – Per manufacturing site

USD 50 – Per product variant

These cosmetic import registration fees must be paid online through the CDSCO SUGAM portal at the time of application submission.

Accurately calculating cosmetic import registration fees and selecting the correct product categories and variants is critical, as CDSCO fees are non-refundable once paid. Errors at this stage often lead to regulatory queries or resubmission of applications. Importers seeking professional assistance for fee calculation, documentation review, and SUGAM portal filing may refer to our CDSCO Cosmetic Import License (COS-1, COS-2) Consultant in India services for end-to-end regulatory support.

How Are Cosmetic Import Registration Fees Calculated?

The total cosmetic import registration fee depends on three factors:

Number of cosmetic categories (as listed in the Third Schedule)

Number of manufacturing locations

Total product variants under each category

For example, importing two cosmetic categories manufactured at one site with ten variants each will require fees for:

Two categories

One manufacturing site

Twenty variants

Correct classification is critical, as incorrect fee calculation may lead to application rejection or resubmission.

Are Cosmetic Import License Fees Refundable?

No. CDSCO does not refund cosmetic import registration fees, even if the application is rejected or withdrawn. Therefore, importers must ensure that:

Product categories are selected correctly

Manufacturer details match supporting documents

Variants are declared accurately

Professional review before submission helps avoid unnecessary financial loss.

Common Mistakes While Paying Cosmetic Import Registration Fees

Importers often face delays due to avoidable errors, such as:

Selecting the wrong cosmetic category

Paying fees for unnecessary variants

Mismatch between fee challan and application details

Using incorrect manufacturer information

These issues often trigger regulatory queries or lead to application rejection.

Incomplete or inconsistent documentation submitted with the government fee challan often causes delays in cosmetic import registration. Incorrect ingredient declarations, mismatched manufacturer details, or non-compliant labeling artwork frequently trigger CDSCO queries. To avoid these issues, importers should review the complete list of required documents in advance, as outlined in our detailed guide on Documents Required for Cosmetic Import License.

Can Cosmetic Import Registration Fees Be Reduced?

CDSCO does not provide fee waivers or discounts. However, strategic planning can help optimize costs by:

Grouping similar products under one category

Avoiding duplicate variant filings

Using accurate manufacturer documentation

Experienced regulatory consultants help structure applications efficiently.

How Regacats Solutions Assists with Cosmetic Import Registration Fees

Regacats Solutions provides end-to-end support for managing cosmetic import registration fees and CDSCO filings, including:

Correct category and variant classification

Fee calculation and challan preparation

SUGAM portal filing and submission

Regulatory query handling

With expert guidance at Regacats Solutions, many importers complete the cosmetic import registration process within 30–35 working days.

About Regacats Solutions

Regacats Solutions is an India-based regulatory consulting firm specializing in CDSCO and statutory compliance for regulated industries. With extensive experience in cosmetic import licensing, medical device registration, and FSSAI regulatory approvals, we assist Indian importers and international manufacturers in navigating complex Indian regulations. Our expertise covers CDSCO cosmetic import license (COS-1 & COS-2), medical device import registration, Legal Metrology compliance, and EPR authorization. Regacats Solutions focuses on India-specific regulatory frameworks, ensuring accurate documentation, faster approvals, and long-term compliance for businesses entering or expanding in the Indian market.

Content Reviewed

Content reviewed by Regulatory Experts at Regacats Solutions

Specialists in CDSCO cosmetic import licensing, medical device import registration, Legal Metrology compliance, EPR authorization, and FSSAI regulatory consulting in India.

FAQs – Cosmetic Import Registration Fees

For a detailed understanding of the CDSCO cosmetic import approval process beyond fees, refer to our Cosmetic Import License in India: CDSCO COS-1 & COS-2 Guide.